Highly recommended tools

RealTest - backtesting & analysis

Simple yet powerful

Developed by Marsten Parker, the only systematic trader to appear in Jack Schwager’s Market Wizards books, we believe this product represents the single best value back-testing engine on the market.

Using an intuitive script syntax that is easy to learn, you’ll get moving quickly, particularly with the many sample scripts provided. Despite this simplicity, there is enormous power and functionality under the hood. Perhaps the fastest back-testing engine on the market, it is able to handle stocks, currencies and futures with ease. There’s also a vibrant and helpful community on the RealTest forum.

Key Features

- Multi-Strategy Modeling: combine multiple strategies across long/short, strategy type, market, bar size and view true portfolio based results and correlations easily.

- Actual Trade Testing: users can import actual trades and compare them against backtest results.

- Powerful Optimisation & Analysis Tools: including interval tests, walk-forward, monte-carlo, genetic optimisation and so on. There are powerful analysis tools that allow the user to do research on the markets above and beyond ‘just backtesting’.

- Detail Results Analysis: best in class analysis tools, including drill-down capabilities into individual strategy results, view trades on charts, write custom metrics and so on.

- Data Integration: RealTest integrates seamlessly with data providers like Norgate Data. Everything is taken care of so you can start building strategies on highly accurate data, without survivorship bias, right away. Supports Stocks, ETFs, Futures and FX.

- Order List Generation: easily generate orders for live trading.

We're not affiliates! We just love the software.

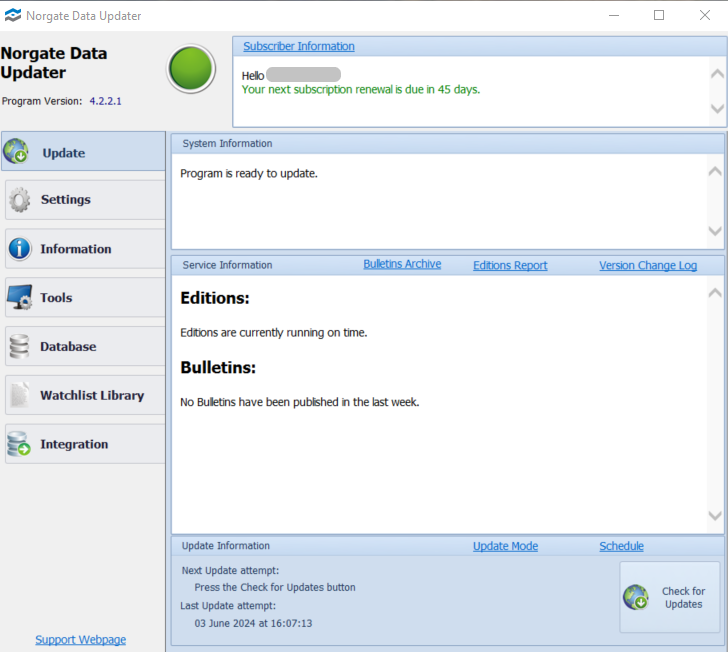

Norgate - clean data

High quality data is paramount

Norgate data is exceptional quality, value for money, and integrates directly with RealTest, Python & other backtesting engines. Specialising in survivorship-bias free data, they cover the US, Australian & Canadian stock markets, as well as selected futures, forex & other data. You literally cannot get off the ground with quant trading unless your data is first rate.

There is no intra-day data, but end-of-day data is extensive, with US stock data going back to 1950, over a 100 futures markets, spot FX, global indeces and much more. Naturally it updates daily for live trading.

We’ve trialled a lot of data suppliers over the years and no one comes close to Norgate for quality, pricing, service or ease of use.

Key features

- Comprehensive Historical Data: with an extensive history, index constituent information and de-listed stocks, Norgate is a one-stop-shop for all you need in this space.

- Data Quality & Adjustment: stocks can be adjusted using multiple methodologies to manage corporate actions like stock splits & dividends. For futures data, back-adjusted & unadjusted continuous contracts are provided.

- Automatic Updates: running in the background, your historic data is kept up to date automatically as it becomes available.

Frequently Asked Questions

What can't RealTest do?

RT handles equities, futures, fx & crypto just fine, but only with End-Of-Day data (daily bars). There is not (yet) capability to backtest on intraday data. It’s also not the application you want for fancy charting. Finally, because RT uses a scripting langugae of its own, there are some limitations in bespoke programming, however, we have almost never found this to be a limitation for the creative thinker. Given how well it does multi-strategy, portfolio testing, it’s very much worth it.

What can't Norgate do?

Norgate presently is all you’d ever need for end of day stock trading, but like RT, there is no intraday data. Forex and economic data are also available and so is futures data, although you should compare and contrast to CSI for futures data depending on your exact requirements.

Other popular back-testing applications?

Amibroker is a popular alternative to RealTest, particular for intra-day systems. For futures and currency traders of course Trade Station is popular, although we feel Multi-Charts is a much better alternative. Strategy Quant-X is an extremely powerful machine learning and backtesting tool, but beware of using it to simply over-fit the data. Python tools are everywhere if you want to use them for back-testing, but this is obviously a lot more work. For reasons more related to brokers than productivity, MT4 and MT5 remain popular tools. We don’t recommend them.

Naturally Trade View is always handing for charting and monitoring the markets for free.

For more on the topic, check out the post and podcast here: Episode 24 – Battle of the backtesters.

Using Python for backtesting?

If you’ve never coded or back-tested before, we’d recommend using something like RealTest before investing thousands of hours into becoming a Python guru. You may not even decided to proceed with trading! However, if you are ready to get going with Python the best place to start is with the courses provided by Tom Starke.

Other data sources?

This list will get you started. See Quantpedia.

How difficult is it to get started? I'm not a programmer!

It doesn’t have to be that difficult, you probably need 6 months of say 5-10 hours a week to really get moving. You’d start with our introductory courses, use the software we recommend, perhaps jump into one of our more advanced courses and you become relatively proficient in no time.

It helps of course if you are analytical, enjoy tinkering with data in analysis projects and really have a desire to crack it. It’s best to start with a simple project so you have a purpose, a problem to solve. Jump into the Algo Collective community to get started asking questions.